Zakat: The Essential Guide

With Ramadan now here, many of us are preparing to give our annual Zakat. Calculating your Zakat and getting your head around the basics can be sometimes difficult and for that reason, we have created this short guide, as well as developing this handy Zakat calculator. We've broken down some of the most common questions and cleared up the main misconceptions about Zakat.

What is Zakat and why is it important to me?

'You shall observe the Salah and give the obligatory charity (Zakat), and bow down with those who bow down.' (Qur’an 2:43)

Zakat is the third pillar of Islam. It is an obligatory act of charity amounting to 2.5% of a Muslims annual savings. Zakat is intended to purify our wealth, not only physically, but also spiritually. It purifies our heart against selfishness as well as ensuring that society's poorest are protected against hunger and destitution.

A common misconception is that Zakat is a form of tax. However, it is a spiritual obligation in which we will be accountable to Allah directly. Zakat plays a key role in not only enshrining the rights of the poorest in the community, it also facilitates in enabling them to gain the skills and aid needed in today’s economy to come out of a life of poverty. Zakat also crucially builds a relationship of consideration and appreciation between different members of society by providing ongoing support from the rich to the poor.

Who has to pay Zakat?

To pay Zakat or not to pay Zakat? That is the question. The answer to this question is simple! The only conditions of Zakat are:

- You have to be Muslim

- You have to be above the age of puberty

- You have to meet the condition of nisab - a threshold that indicates your financial eligibility to pay Zakat*

*This threshold must be maintained for one lunar year for Zakat to be required and must be paid as soon as it is due. However, the month of Ramadan is not the only month that you can choose to pay out your Zakat - you can choose any other month.

In the simplest of terms, if you have saved wealth over the threshold of nisab, then you are required to pay Zakat.

How much Zakat do I need to pay?

Our Prophet Muhammed (saw) has set nisab at the rate equivalent to 87.5 grams of gold or 612.4 grams of silver. Today this is usually the equivalent value in your local currency. In the Hanafi madhab, the value of silver is used to determine the nisab eligibility to pay Zakat and in other madhabs the value of gold is used. As the value of gold and silver change daily, make sure to check our Zakat page for the latest rate of nisab.

What do I need to pay Zakat on?

Zakat should be paid on wealth rather than income. If we take the example of Adam (our fictional character) who earns £20,000 a year and has £200 pounds as part of his yearly savings, Adam would have to calculate his Zakat from the £200 in his savings as opposed to his yearly income.

Zakat is to be paid on cash, gold and business assets. For a full list of what you need to pay Zakat on check out our Zakat page.

Another commonly asked question is whether Zakat needs to be paid on valuable items such as property or cars. The answer to this question is, no. These items are exempt. However, if you intend to sell these items then it becomes a trading good and Zakat will be due on such items if a lunar year passes from the time of your intention to sell.

How do I calculate how much Zakat I need to pay?

We know that calculating your Zakat can be a daunting task if you don’t know how to go about the process correctly. There are so many variables to consider so we’ve devised a simple Zakat calculator to help you calculate what you're due to pay.

Should I be paying my missed Zakat?

It can be easy to forget to pay or to miscalculate our Zakat or we may even be new to recognising this pillar of Islam. However, it’s never too late to pay off our Zakat from previous years. Missed Zakat would be calculated in the same way you calculate your current Zakat except you use the nisab from the missed Zakat year as opposed to the current nisab value.

What should Zakat be spent on?

Zakat is a vital tool in the fight against poverty. Zakat needs to be distributed in the poorest communities and can be used towards improving education, the environment, health, food security and more. For the past 30 years, Muslim Hands has distributed over £50,000,000 in Zakat in over 30 countries.

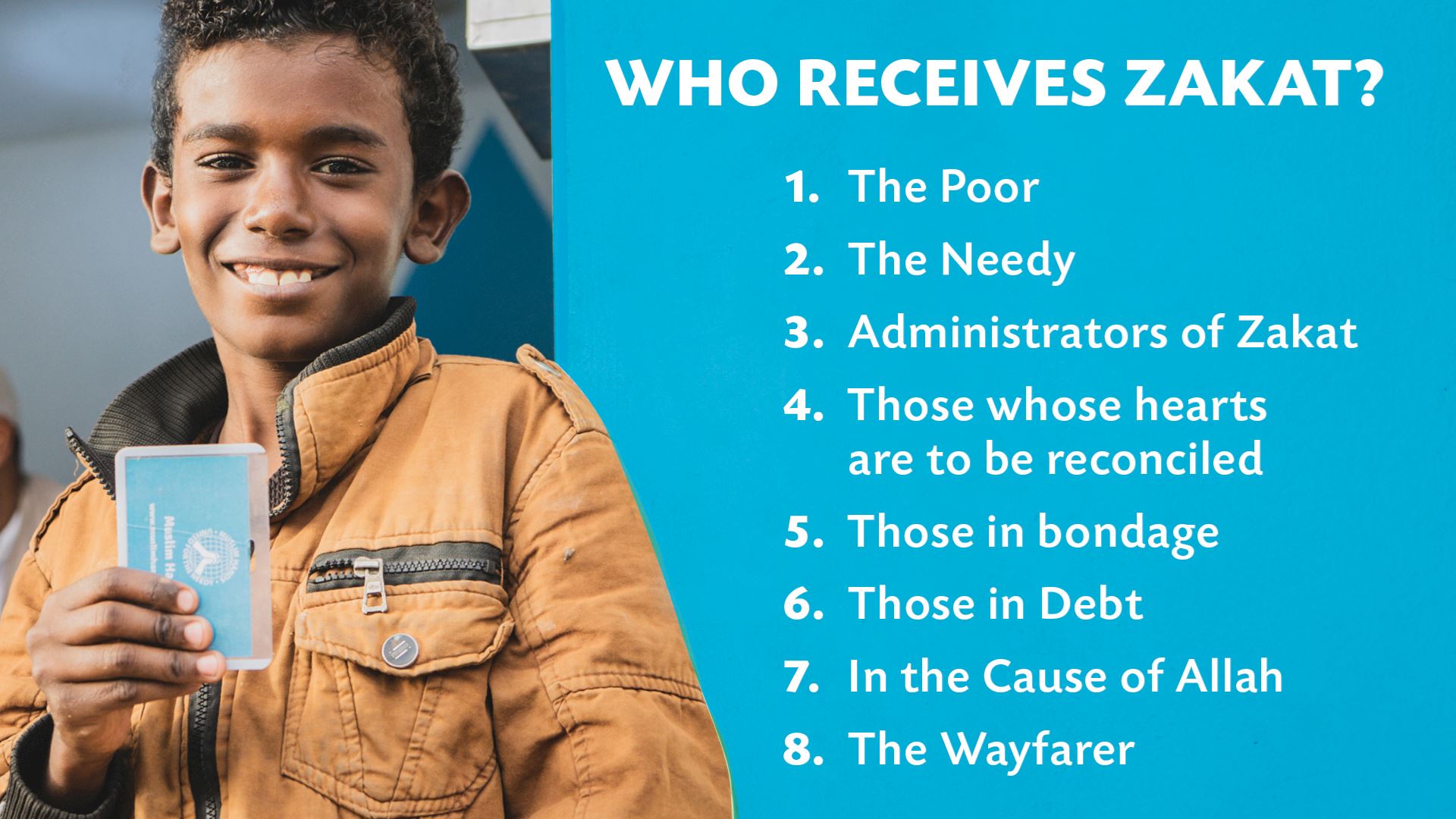

Zakat can be used towards helping the poor break out of the cycle of poverty. However, there are conditions regarding who can and who cannot receive Zakat. In the Qur’an (9:60), the categories of people entitled to receive Zakat are described:

- The Poor - Those receiving little or no income.

- The Needy - Someone who is struggling to meet their basic needs.

- Administrators of Zakat - Those who are responsible for collecting, storing, guarding, registering and distributing Zakat.

- Those whose hearts are to be reconciled - Those who are new to Islam.

- Those in bondage - Freeing those who are enslaved/ held captive.

- Those in Debt - As long as the debts were not incurred through acts against Islamic law.

- In the Cause of Allah - Anything promoting Islamic values such as funding the building or the running of a madrasa or other educational programmes.

- The Wayfarer - Anyone who is stranded whilst travelling or away from home and needs financial assistance – as long as they travelled for lawful purposes.

What is Zakat al-Fitr (Fitrana)?

Fitrana is not the same as Zakat. Unlike Zakat, Fitrana is an obligatory charity which must be paid before Eid al-Fitr. It is compulsory on every individual in your household regardless of wealth. However, self-dependent adults are required to pay on behalf of their dependants such as children or the elderly. Fitrana is the equivalent of 1 Sa' (two handfuls) of food, grain or dried fruit for each member of the family. If you haven’t paid your Zakat al-Fitr for this year, you can do so by going on our donation page.

We hope this guide was useful, in sha Allah. If you are overwhelmed by the calculation or just need general help, don’t hesitate to call us and we will work with you to discuss any queries.