Our Top Tips for Giving Zakat!

The below article is based on Hanafi fiqh, though we do allude to differences of opinion in some sections.

Did you know? Our deeds are raised to Allah (swt) every Sha'ban [Nasa'i], in a year-end accounting of our actions. Rajab is the last month before Sha'ban, so it's the perfect time to evaluate our year, fulfil any debts or resolutions we had, and make sure we're happy with the actions being taken up to Allah. One of the annual duties we can fulfil in Rajab is Zakat!

Uthman ibn Affan (ra) said, 'This (Rajab) is the month for you to pay your Zakat. If you have any debts then pay them off, so that you can sort out your wealth and take the Zakat from it'. [Malik]

In light of the above advice, we've put together an article to facilitate your Zakat calculations this Rajab!

Alhamdulillah, our team at Muslim Hands have been handling your Zakat for many years! We are also fortunate to have Mufti Muhammad Ismail, Head of the Zakat Committee at Muslim Charities Forum (MCF), to assist us in advising you about this important duty. The following article consists of our top tips on calculating your Zakat in 2023.

From learning how to value your gold, to making sure you're paying Zakat on all the necessary assets, here's what you need to know before giving your Zakat this year!

One: Check the latest value of your gold and silver

If you have gold over 87.48 grams, you need to pay Zakat on it. If you have silver over 612.36 grams, you need to pay Zakat on it. Usually, people will pay their Zakat in cash, so they need to know the price of gold and silver per gram.

Recently, the value of gold has dramatically increased, so it's super-important to get your assets valued. Don't worry - it's really easy!

When it comes to valuing your gold and silver, you have two options:

Option 1: The price of gold and silver is determined by their re-sale value. So the best way to learn the price of your gold is to contact your local jeweller. They will give you the most precise figure according to the value of scrap gold. We recommend this as the most accurate method.

Option 2: Can't get in touch with a jeweller? Simply use today's live gold and silver measurement in grams. This is the universal measurement for gold, which is generally more expensive. On the plus side, you can see the latest prices on our Zakat Calculator! All you have to do is multiply the current price of gold per gram by the total weight of your gold.

Example: Fatima has 100 grams of gold. Today, gold costs £51.03 per gram. This means Fatima has £5,103 worth of gold.

We recommend this as the quickest method.

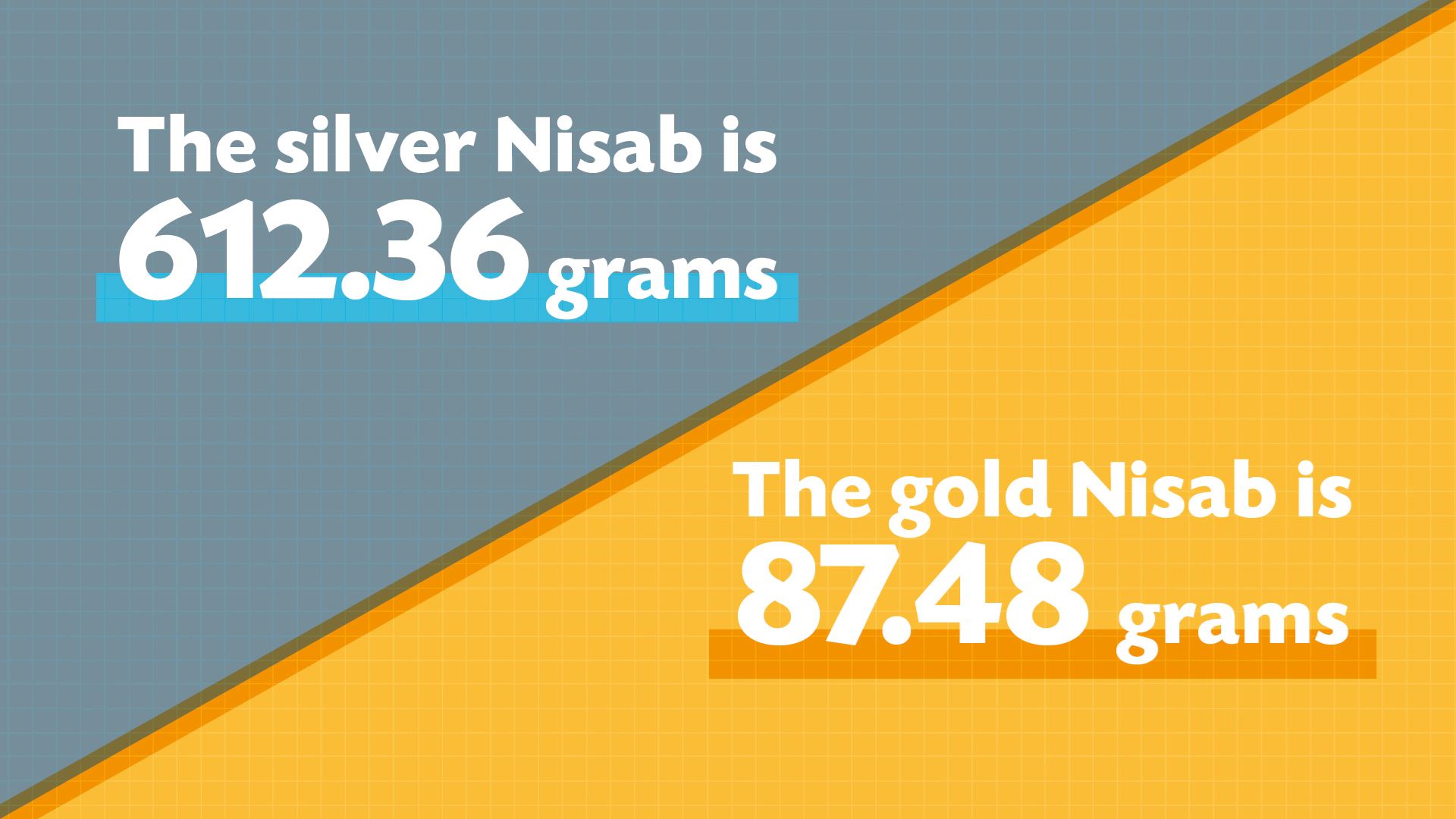

Two: Check the latest Nisab value to calculate correctly

Nisab basically means the minimum amount of wealth you need to have before you must pay Zakat on it. The figure for Nisab fluctuates a bit from year to year, because it is based on the value of gold and silver.

So how can you calculate your Zakat based on wealth?

- The silver Nisab is currently around £373.

- Calculate the worth of all your assets - such as your cash and property.

- Do you have more than £373 worth of assets? Then you need to pay 2.5% Zakat on that wealth.

You can always see the latest silver Nisab on our Zakat Calculator - so be sure to bookmark that page!

We use the silver Nisab to calculate how much Zakat to pay on our cash, our property, our investments, our businesses etc. - as well as our silver assets. Meanwhile, the gold Nisab is used to calculate the Zakat for our gold assets - as seen below!

Three: Be aware of paying Zakat on gold jewellery

If you have gold assets above the gold Nisab (currently around £4,500), then you need to pay Zakat on that too.

There is a difference of opinion on whether or not you need to pay Zakat on jewellery:

- Some scholars state you need to pay Zakat on all gold and silver (above the Nisab level), including jewellery. However, you don’t have to pay Zakat on other precious metals like platinum, nor on precious stones like diamonds. Moreover, some scholars say that mixed metals are only liable for Zakat if half or more of the metal is gold or silver.

- Other scholars say if women are only using that jewellery for personal ornamentation, and it is not used as an asset, then you don’t have to pay Zakat on it.

- If you are buying jewellery for the purpose of accumulating wealth or selling it later, or if you have what would generally be considered an extravagant amount, then that jewellery is no longer mere ornamentation and you need to pay Zakat on it.

The above difference of opinion could make it easier for sisters who have not been able to work in the last year due to the coronavirus crisis, but still own gold jewellery which has suddenly gone up in value. You can go with the easier opinion of not paying Zakat on jewellery that is just for ornamentation and isn't an asset.

However, many sisters may prefer to pay Zakat on all their gold and silver, for two reasons. Firstly, it gives you peace of mind that you have fulfilled your Zakat absolutely, removing any doubt from your mind. Secondly, giving Zakat purifies and increases our wealth, and Allah (swt) is the Ultimate Provider:

And Allah knows best!

Four: Be aware of paying Zakat on all eligible assets

There are many assets you may forget when paying Zakat! Here are a few things to consider:

- Pensions: Zakat must be paid on the amount of your pension that you have contributed (voluntary contributions) within your Zakat year, but not on the portion paid by your employer.

- Shares: If you don’t intend to sell the shares, then Zakat is due on dividends you earn from them. However, if you are buying and selling shares, then Zakat is due on their current market value.

- Property: Any property other than your home must be considered for Zakat. If you are in the business of buying and then selling properties when they appreciate in value, then Zakat is due on the current resale value of these properties. However, If you are in the business of letting properties (rather than buying and selling them), then Zakat is due on savings made from this rental income only.

- Loans: Have you lent anyone money this year? If you believe your debt can be recovered on demand, then you need to pay Zakat on it this year. However, if you have doubts about recovering this debt, you don't need to pay Zakat on it until you actually receive this money. At that point, you will also need to pay Zakat for all the previous years when the debt was outstanding.

You also need to make sure you're not paying Zakat where you don't need to!

- Any unpaid rent, house payments, utility bills that are due or overdue should be excluded when calculating your Zakat.

- Any money that you owe should be paid before you calculate your Zakat. As mentioned before, Uthman (ra) advised that we do this in Rajab.

- If you own a business, any unpaid rent, property payments, invoices or staff salaries that are due or overdue should be excluded.

Our handy Zakat Calculator takes all this into account when calculating your Zakat.

Five: Keep records of every time you give Zakat

Zakat is due on your wealth annually, but there are many people who don't necessarily pay one lump sum at the end of the year. Rather, people give Zakat:

- If they see a cause during the year which they really want to give towards

- At blessed times, to gain extra rewards - for example, in the last ten nights of Ramadan

- In monthly instalments, to make it more manageable - for example, as an orphan sponsorship

It is fine to pay Zakat at different times in the year. It's fine even to give future Zakat this year, if there's a cause you really want to support. Just remember to keep a clear record of every time you give Zakat and to calculate whether you paid the correct Zakat at the end of the year.

This is an important obligation, often mentioned in the same ayah as Salah and we don't want to accidentally give less than what Allah has commanded!

Further resources

We have a few other articles which answer your Zakat FAQs - so check these out!

And of course, our Zakat Calculator is always available to support you!

We hope this article was helpful to you, and we wish you a most blessed Rajab! As the Prophet (saw) said, 'O Allah, bless us in our Rajab and Sha'ban and enable us to reach Ramadan' [Ahmad]. Ameen!

Please do get in touch with our team on 0115 911 7222 if you have any further questions.